GOLD COIN PORTFOLIO MANAGEMENT

U.S. BULLION AND RARE COINS - SINCE 1977

Accounts From $100,000 to $10,000,000

Eagles Of

America

Q&A

Q: Who is Les Fox and Eagles of America?

A: Born in New York City in 1947, I’ve been a rare coin dealer since 1969. From 1969 to 1974 I worked as a Trade Development agent for the Port Authority of New York and New Jersey. I worked in the World Trade Center in 1972, the year before it officially opened to the public. I also operated a small rare coin investment business called “Fox Coin Portfolios” from of my apartment in Queens. In 1974, I accepted a position at Deak-Perera and worked in the “Perera Fifth Avenue” showroom located next door to the U.S. Passport Office in Rockefeller Center across the street from St. Patrick’s Cathedral. Outside our front door was the famous “Atlas” statue.

Q: What was happening with Gold in 1974?

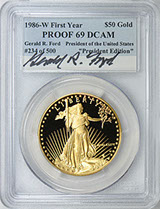

A: 1974 was an exciting year for Gold. After being demonetized in 1933, with gold bullion sales restricted to numismatic coins for 40 years, President Gerald Ford re-legalized the ownership of Gold in all forms in 1974. (I was interviewed on the front page of the New York Times when sales resumed in 1974.) It is said that Gerald Ford was influenced by Gold advocate Jim Blanchard to legalize the precious metal. Note: I taught Jim Blanchard about rare coins and helped him sell coins to his clients in 1975. In 1986, the U.S. Mint began to issue new Gold Coins with the American Eagle coin program. In 2001, President Ford personally autographed 500 PCGS “President Edition” cards for me which were encapsulated with Proof 69 1986 $50 Gold Eagle coins. In 1974, when the New York City real estate market collapsed I also had an opportunity to buy a mansion on 51st Street and 5th Avenue for $124,000 but I couldn’t afford it. Today, that property (including “air rights”) is probably worth $100 million! (Oh, well.)

Jim Blanchard

Jim Blanchard

Q: Are Rare Gold Coins worth buying at today’s prices?

A: I think so. But you absolutely have to know what you’re doing in order to buy the right coins at the right price. Among the many U.S. Gold Series we love are the $5 Half Eagles of the 1820’s and 1830’s. Also, the $5 Indian Gold Coins dated 1908 to 1929. The earlier coins are very expensive in any condition. There were several of these in our 1988 auction and prices have soared since then. However, at today’s six and seven figure prices early Half Eagles (which began in 1795) have moved into very strong hands. Rich folks, billionaires and art collectors have joined coin collectors in appreciating the beauty and pride of ownership of these Classic Gold Rarities and I doubt they will ever decrease in value to where they were in the 1980’s. As an investment, of course, nothing is guaranteed. So I tell my clients to buy rare coins (as well as bullion coins) as a “smart speculation.” Like real estate. But unlike real estate, rare coins are not income-producing, so don’t borrow money to buy coins.

Q: Which specific coins do you recommend?

A: We like all Gold Coins. However, your personal finances, preferences and risk-tolerance will determine the coins I recommend. Depending on the size of your Gold Coin Portfolio (we manage portfolios from $100,000 to $10,000,000+) the breakdown of Bullion coins vs. Rare Coins could be anywhere from 50-50 to 90-10. In the case of Gold Bullion coins, we see no reason to buy anything other than American Eagle coins or $5, $10 and $20 Gold coins dated from the 1880’s to 1928. Liberty, Indian and St. Gaudens Half Eagles, Eagles and Double Eagles carry a bigger premium than American Eagle coins, but some people like the look and feel of older, more historic coins. Of course, even "common dates” among the pre-1930 coins (like 1901, 1908, 1924-1928 and 1932) can carry much larger premiums for coins in MS-65 and higher grades. As mentioned, we are quite familiar with U.S. Gold Coins dating back to 1795-1840 and we are fully qualified to make recommendations in that category. Hopefully, if you decide to buy Rare U.S. Gold Coins it will turn out to be a good investment. Building a meaningful collection, such as a "Type Set” (one of each design) or collecting a series by date and mint-mark, such as $5 Indians from 1908 to 1929 or selected coins from the $2-1/2 , $5, $10 or $20 Liberty series, can also be a fun and exciting challenge.

Q: Is it easy to get ripped off buying Rare U.S. Gold Coins?

A: Very easy. The price difference between an MS-62 to MS-64 coin and an MS-65 or higher coin can be significant especially with rarer coins. Similarly, the premium for an MS-64 to MS-67 rare U.S. Gold Coin is not based on a mathematical formula. Each coin must be evaluated on its own merits. So if you have the only example of a particular coin in MS-67 it is worth more than if there are 5 other MS-67’s. Although an MS-67 St. Gaudens $20 Gold Double Eagle is rarer than an MS-66, there is no comparison between an MS-67 St. Gaudens Double Eagle and the much rarer MS-67 Liberty Double Eagle. In the case of rare date coins like the incredible Clapp 1897-O New Orleans $10 Liberty Gold Eagle from our 1988 Amazing Gold Rarities auction (and the 1982 Eliasberg collection), MS-67’s are even rarer. (Auctioned for $264,000 in 2018.) Hence, a newly discovered date in this category could be worth half (or double) the price you pay. We have more to say on this subject, which will be discussed with you strictly confidentially if you become one of our private clients. Important: Even PCGS and NGC graded coins can be better or worse than their numerical grade suggests.

Q: How do I become a client?

A: I work with a very small number of affluent clients. If you would like to become a client please contact me by email and send me $100 for an initial 1-hour consultation. (PayPal to me at: lesfoxnj@yahoo.com.) If you decide to proceed, we will develop a plan to structure a Gold Coin portfolio to fit your needs. My fee to manage a portfolio is 2% to 5% annually which includes recommendations to buy and sell, acquisition of coins privately and publicly (auctions) and other advisory services including insuring, transporting and protecting your coin portfolio.

Q: Do I have to be your exclusive client?

A: No. You can do business with any dealer you choose. We are happy to evaluate coins purchased from other dealers. There are a number of reputable dealers who can provide you with great coins for fair prices. Many of our recommendations involve other dealers and major auction houses like Heritage. (We have been a PCGS authorized dealer for more than 20 years.) If you have acquired high quality coins elsewhere, we will gladly support all of your decisions. As a client, you are under no obligation to follow my advice and you can terminate our arrangement at any time. Basically, this is an informal, handshake agreement.

Q: Why should I trust Les Fox?

A: As America’s #1 U.S. Gold Coin expert for more than 50 years, my articles about U.S. Gold Coins have appeared in The Coin Dealer Newsletter and other numismatic publications. (I’m especially proud of my story about the under-rated $2-1/2 Gold series, which I think is still under-rated due to the small size of the coins.) I’ve been writing and publishing books about rare coins since 1977. My latest book “GOLD vs BITCOIN” will be published in July, 2023. From 1985 to 1988, I worked closely with David W. Akers (acknowledged as the ultimate authority on U.S. Gold Coins) who helped me acquire many amazing coins for our 1988 auction. My good friend Miles Standish and I launched the PCGS Autographed Coin program which featured coins encapsulated with original PCGS signature cards personally signed for us by Presidents Ford and Bush in 2001 and 2002. In 2001, I published “The U.S. Rare Coin Handbook.” In 2007, I also created "Eagles Of America Rare Coin Trading Cards" with the Upper Deck company but this extremely creative project never reached its potential.

Breathtaking 1856-S $2-1/2 Liberty Gold Quarter Eagle

Breathtaking 1856-S $2-1/2 Liberty Gold Quarter Eagle

Q: Are you an expert in anything besides U.S. Gold Coins?

A: Yes. I’m also an expert in 19th and 20th Century American (and non-American) paintings. I’ve written two books on this subject, both on Amazon. If you’d like to add important paintings by listed artists to your portfolio, I work closely with Sotheby’s, Christie’s and a number of art museums. Art is also exciting to own and enjoy and, unlike rare coins, it can be prominently displayed on the walls of your home or office with less concern for security. In 2021, my wife and I wrote and published the Catalogue Raisonne for American artist Fern I. Coppedge (1883-1951), whose work we collect and highly recommend. I’m also an expert in real estate (I’ve built many custom homes including super-luxury waterfront homes in Jupiter, Florida and beautiful homes in Palm Beach, as well as in Saddle River and Franklin Lakes, New Jersey. In all modesty, I might be the only rare coin dealer who can also help you build an art collection and a new home! (Important: I’m not a stock market advisor.) Besides U.S. Gold Coins I like World Gold Coins notably English and French coins which are comparatively cheap. I also like Tiffany lamps, but I would need to consult with other experts if that’s something you want to own.

Visit my Websites at: www.AmericanArtAdvisor.com and www.FernCoppedge.com

Eagles Of America

©2023. West Highland Publishing, LLC • P.O. Box 15276 • Sarasota, FL 34277

Email: lesfoxnj@yahoo.com.